What is a Percentage Calculator and How Does it Work?

A Percentage Calculator, in its most straightforward form, is an online tool, or app, where you enter two (or possibly three) numbers, and it finds the percentage result for you. It answers questions like:

- “What is X%X % of Y?”

- “X is what percent of Y?”

- “Y is what value when X%% % is applied?”

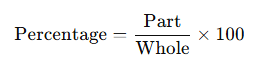

These questions can often be written in formula form, but using the tool removes the manual calculations and reduces the risk of error. For example:

And a dedicated tool does that in a click.

On a page at AllCalculatorHub.com, our Percentage Calculator is made ultra-simple with an easy-to-navigate format where you select what type of calculation (such as percent of, the value when given a percent), enter the numbers, and instantly receive the answer. Unique features include clear labelling of input fields, automatic recalculation as you edit, and the ability to handle reverse percentage questions (for example: “If after tax I have Y, what was the original amount before X % tax?”). It also shows your result along with a plain-language explanation so you understand what it means—not just a number.

Why Use a Percentage Calculator?

The advantages of using a dedicated Percentage Calculator tool are numerous:

- Speed & efficiency: it can deliver your answers within seconds, whilst avoiding long manual calculations and small mathematical errors.

- Precision: Working out percentages on paper often leads to errors, mostly for decimal or negative percentages. A tool guarantees accuracy.

- Flexibility: The tool is useful for many types of percentage calculations: increases, decreases, what percent one value is of another value, etc.

- Ease for non-mathematicians: You don’t need to memorize a formula; the user interface tells you how.

- Better decision-making: In the context of financial planning (budgeting, investing), having precise percentages makes your decisions smarter and more grounded.

How the Percentage Calculator Supports Financial Planning

When it comes to financial planning, percentages are everywhere: tracking how much of your income goes to savings, analysing how much interest you earn, measuring portfolio growth, assessing expense changes, and so on. A Percentage Calculator becomes a handy tool in these scenarios.

Real World Examples

1. Budgeting and Savings

If your monthly income is ₹ 70,000 and you want to save 15%, the tool simply says: “15% of 70,000 = result”. You will learn that the 15% works out to ₹ 10,500. Now you know you will need to save ₹ 10,500 every month.

2. Investment Growth

Imagine you invested ₹ 1,00,000 in a fund and it has grown to ₹ 1,20,000 in one year. What is the percentage growth?

Use the tool (or manual formula): (1,20,000 – 1,00,000) ÷ 1,00,000 × 100 = 20 %.

Knowing this quickly helps you compare different investment opportunities.

3. Expense Reduction Scenario

If your monthly utility bill drops from ₹ 8,000 to ₹ 6,400, you saved ₹ 1,600. What’s the percentage reduction? Input the drop and original figure: 1,600 ÷ 8,000 × 100 = 20%. You can understand that you reduced that expense by 20 %.

4. Loan Interest / Fee Calculation

If a loan carries an extra fee of 2.5% on the principal of ₹ 5,00,000, the tool tells you the fee is ₹ 12,500. Armed with that exact number, you make an informed decision.

These illustrate how a Percentage Calculator bolsters financial planning by converting abstract percentages into concrete amounts and helping you interpret what those percentages mean for your personal numbers.

How to Use the Percentage Tool on this Webpage

Here are a few simple actions to get a lot out of the tool:

- Select the correct calculation mode: Decide between “what is X% % of Y”, “Y is what percent of X”, or “Y is X% % increase/decrease from W”.

- Use an accurate input: by using “whole” and “part” in the correct context. For example, use gross income or a specific expense, such as its original value versus its current discounted value.

- Understand the answer: by asking yourself, What does this value mean in context?” Don’t end your thinking at simply knowing the final number. E.g., “₹ 20,000 is 28.6% of my income”—so what? Decide if that’s acceptable or needs adjustment.

- Apply the result to decision-making: If the tool tells you your savings allocation is only 10 % but your goal is 20 %, adjust your budget.

- Use repeatedly for scenarios: Try “what if” analyses. What if your income increases by 10 %? What if your expense falls by 5 %? The tool helps quickly model these.

- Document and track over time: Use the calculator periodically to check changes in your percentages—e.g., what percent of your income each month goes to debt repayment—and watch trends.

Key Features That Make This Percentage Calculator Stand Out

On the AllCalculatorHub webpage,e you’ll find several unique attributes:

- Multiple calculation types (forward, reverse, change) so you’re not restricted to only one kind of percentage question.

- Instant update and responsive design: Works well on both desktop and mobile, so you can calculate on the go.

- Clear results accompanied by explanations: The tool presents both the current number and contextual wording (e, “Your amount equals 18.2% of the total.”)

- No signup or cost: You can use the tool simply and immediately, without signing up or paying for the calculator, making it perfect for quick, everyday use.

- History or result copy: In some versions, you can either copy a result or look back at past calculations, which is useful if you want to compare different calculations.

These three features allow the Percentage Calculator to be more than a basic “plug in numbers” tool and provide a practical addition to your financial toolbox. Actionable tips for readers—Make the Most Use of Your Percentage Calculator

Actionable Tips for Readers: Make the Most of Your Percentage Calculator

- Start with a financial goal: If your objective is to save or allocate 20% of your income, use the calculator to determine that exact number, then adjust your budget.

- Track percentage of income over time: Use the tool monthly, e.g., travel expenses as a percentage of net income. If the percentage creeps up, take note.

- Calculate percentage change when reviewing any investments: When analyzing your investment portfolio, calculate the percentage change annually instead of just gain or loss numbers.

- Evaluating Discount or Mark-up Comparisons: When shopping or reviewing products, you can work out “X% off” or “Y% mark-up” to give you clarity in your decisions.

- Evaluating “what if” scenarios: what if my salary were 8% more, or if my loan interest went up 1%? Use the calculator to convert those possibilities into clear numbers.

- Use reverse percentage questions: If you know how much you paid after tax and the tax rate, use the reverse mode of the calculator to find the pre-tax cost.

- Avoid relying solely on raw numbers: Use the percentages to interpret meaning. For instance, ₹ 5,000 saved each month is good, but if that is only 5% of your income and your goal is 15%, you have a gap to close.

- Record and review: Keep a simple spreadsheet of key percentages (savings rate, debt-repayment rate, investment allocation) each quarter. Use the calculator to update quickly.

In Closing

A percentage calculator is not just a math function; it provides financial clarity by accounting for abstract percentages and comparing what matters. The AllCalculatorHub site, with its eeasy-to-useinterface a variety of calculation modes, and comprehensible results, further supports your management of budgets, investment options, and evaluations.

Whether you are a student, a professional, a small-business owner, or anyone dealing with numbers, you will find that translating percentage values into a quick and accurate method for discrete comparisons is valuable. Use the Percentage Calculator regularly, make it part of your financial routine, and you’ll find that understanding percentages—and what they mean for you—becomes intuitive rather than intimidating.

Start now: pick a percentage scenario meaningful to you (your savings rate, a loan interest, a discount deal) and use the Percentage Calculator to bring clarity. Then ask: “Is this percentage right for me? If not, what should I change?” You’ll be well on your way to stronger financial discipline and smarter choices.